Get This Report about Hsmb Advisory Llc

Get This Report about Hsmb Advisory Llc

Blog Article

The Basic Principles Of Hsmb Advisory Llc

Table of ContentsWhat Does Hsmb Advisory Llc Mean?What Does Hsmb Advisory Llc Mean?Facts About Hsmb Advisory Llc UncoveredHsmb Advisory Llc - An OverviewA Biased View of Hsmb Advisory LlcThe 9-Minute Rule for Hsmb Advisory Llc

Ford says to stay away from "money worth or irreversible" life insurance policy, which is more of a financial investment than an insurance coverage. "Those are extremely made complex, featured high compensations, and 9 out of 10 people don't require them. They're oversold due to the fact that insurance agents make the biggest compensations on these," he claims.

Impairment insurance policy can be costly, however. And for those that go with lasting treatment insurance policy, this plan might make special needs insurance unneeded. Check out a lot more regarding lasting treatment insurance policy and whether it's ideal for you in the next area. Long-term care insurance coverage can help spend for expenditures related to long-term treatment as we age.

A Biased View of Hsmb Advisory Llc

If you have a chronic health and wellness worry, this sort of insurance coverage could wind up being crucial (Health Insurance). Do not let it stress you or your bank account early in lifeit's usually best to take out a plan in your 50s or 60s with the expectancy that you won't be using it till your 70s or later.

If you're a small-business owner, consider securing your income by buying business insurance. In case of a disaster-related closure or period of rebuilding, organization insurance coverage can cover your earnings loss. Consider if a substantial weather occasion affected your storefront or manufacturing facilityhow would that impact your revenue? And for how much time? According to a report by FEMA, in between 4060% of local business never ever reopen their doors adhering to a catastrophe.

And also, utilizing insurance coverage can occasionally set you back more than it saves in the lengthy run. If you get a chip in your windscreen, you may consider covering the repair service expense with your emergency financial savings instead of your vehicle insurance coverage. Life Insurance.

A Biased View of Hsmb Advisory Llc

Share these pointers to shield loved ones from being both underinsured and overinsuredand speak with a trusted expert when required. (https://www.edocr.com/v/rn0xbvw2/hunterblack33701/hsmb-advisory-llc)

Insurance policy that is purchased by a specific for single-person coverage or protection of a family members. The specific pays the premium, rather than employer-based medical insurance where the employer often pays a share of the premium. Individuals might go shopping for and purchase insurance policy from any kind of plans available in the individual's geographic region.

Individuals and families might certify for economic help to lower the cost of insurance coverage premiums and out-of-pocket prices, yet only when registering with Link for Health Colorado. If you experience particular adjustments in your life,, you are eligible for a 60-day duration of time where you can sign up in a private plan, also if it is outside of the yearly open enrollment duration of Nov.

15.

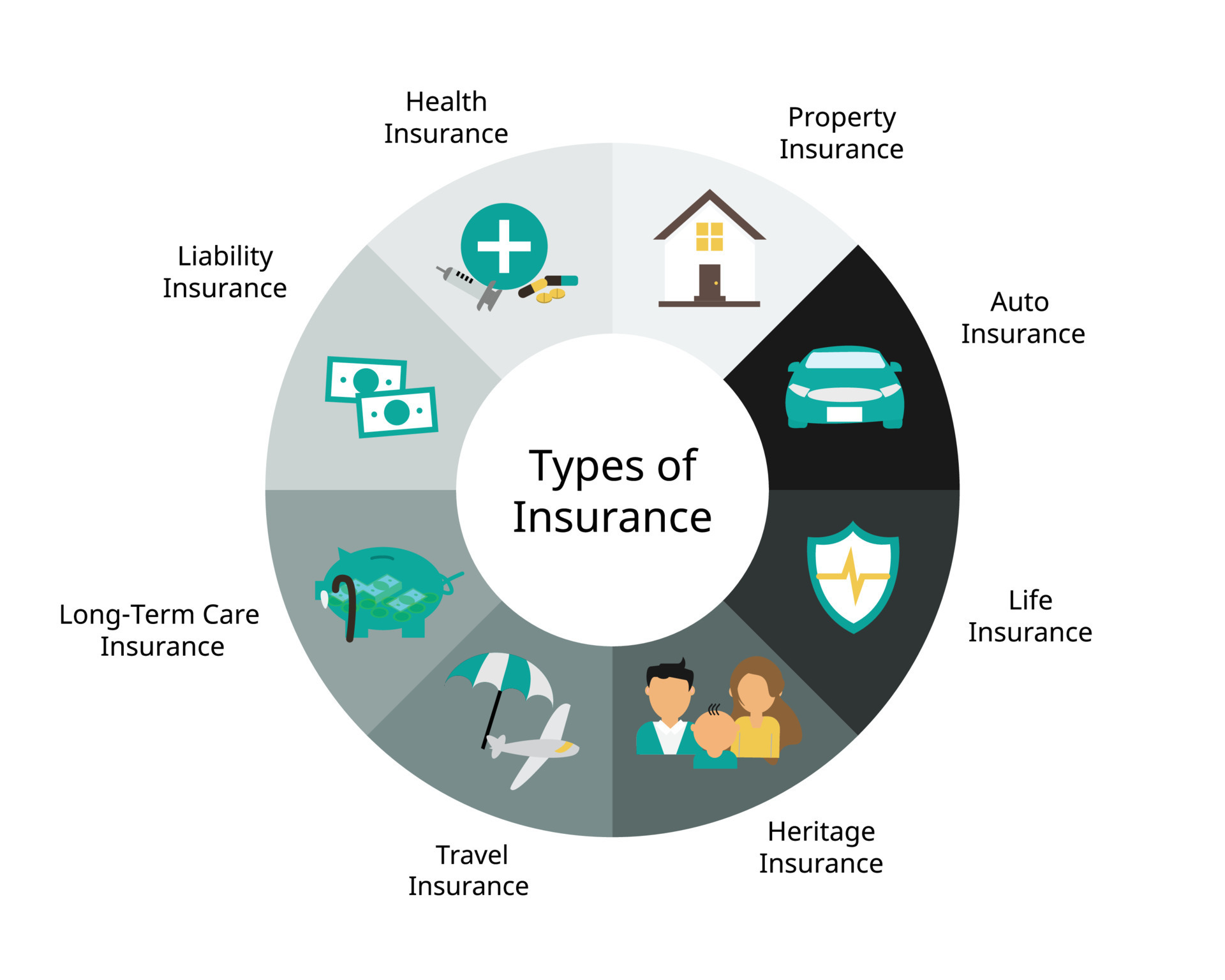

It might appear straightforward yet recognizing insurance types can likewise be confusing. Much of this confusion comes from the insurance coverage industry's recurring objective to make individualized insurance coverage for policyholders. In designing flexible policies, there are a selection to select fromand all of those insurance kinds can make it tough to comprehend what a specific plan is and does.

Not known Facts About Hsmb Advisory Llc

The very best area to begin is to speak about the distinction between the two kinds of standard life insurance coverage: term life insurance and long-term life insurance policy. Term life insurance coverage is life insurance policy that is only active for a time duration. If you pass Recommended Site away throughout this duration, the individual or people you've called as beneficiaries may get the money payment of the plan.

However, lots of term life insurance policies let you convert them to an entire life insurance policy plan, so you don't lose protection. Commonly, term life insurance policy policy premium payments (what you pay per month or year into your policy) are not secured in at the time of acquisition, so every 5 or 10 years you have the policy, your premiums can climb.

They additionally often tend to be more affordable total than entire life, unless you acquire an entire life insurance policy plan when you're young. There are additionally a couple of variants on term life insurance coverage. One, called group term life insurance, prevails among insurance policy options you could have accessibility to with your employer.

Excitement About Hsmb Advisory Llc

This is generally done at no charge to the staff member, with the capability to purchase extra coverage that's obtained of the worker's paycheck. One more variation that you may have accessibility to via your employer is supplementary life insurance policy (Insurance Advise). Supplemental life insurance policy could consist of accidental death and dismemberment (AD&D) insurance policy, or funeral insuranceadditional protection that can help your family in instance something unexpected occurs to you.

Irreversible life insurance policy just refers to any type of life insurance policy plan that does not expire. There are several kinds of long-term life insurancethe most usual kinds being entire life insurance policy and universal life insurance. Whole life insurance policy is exactly what it seems like: life insurance for your entire life that pays out to your beneficiaries when you die.

Report this page